Chat GPT for Accounting: How AI is Transforming the Industry

This article will examine Chat GPT for accounting use cases.

As technology continues to advance, it’s becoming increasingly important for businesses to incorporate it into their operations. One area where technology can make a big difference is in accounting. Accounting software has been around for decades, but recent advances in artificial intelligence (AI) have made it possible to automate many tasks that previously required human intervention. One example of this is ChatGPT.

ChatGPT is a large language model developed by OpenAI. It uses natural language processing (NLP) and machine learning to understand and respond to text-based input. This means that it can understand and generate text just like a human, making it a powerful tool for a variety of applications.

In accounting, ChatGPT can be used in a number of ways to improve efficiency and accuracy. Here are just a few examples:

Chat GPT for Accounting: Answering basic accounting questions

Accounting can be a complex field, and not everyone has the knowledge or expertise to navigate it effectively. ChatGPT can be used to answer basic accounting questions, such as “What is accounts payable?” or “How do I calculate depreciation?” This can save time and reduce the need for employees to seek out help from more experienced colleagues.

Automating data entry

One of the most time-consuming tasks in accounting is data entry. It can be tedious and prone to errors, especially if the data is being entered manually. ChatGPT can automate this process by using NLP to interpret text-based input, such as scanned receipts or invoices. This can help to reduce errors and free up employees’ time to focus on more complex tasks.

Analyzing financial data

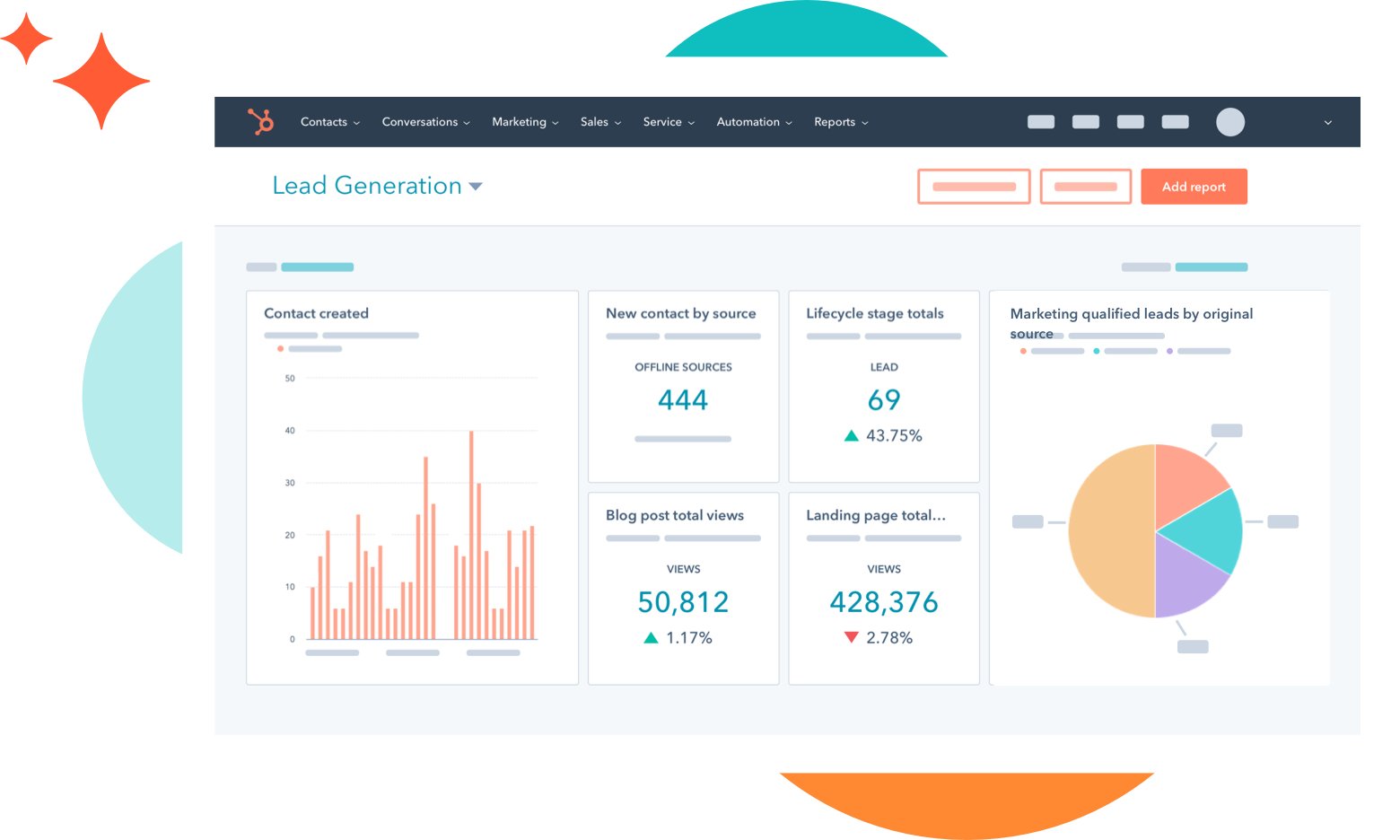

Accounting involves a lot of data analysis, and this is an area where ChatGPT can be particularly useful. It can be trained to analyze financial data and generate reports, such as balance sheets and income statements. This can help businesses to make better-informed decisions and identify areas for improvement.

Managing accounts receivable and payable

Managing accounts receivable and payable can be a time-consuming and complex process. ChatGPT can be used to automate many of the tasks involved, such as generating invoices, tracking payments, and sending reminders for overdue accounts. This can help to reduce errors and ensure that payments are processed in a timely manner.

Assisting with tax preparation

Tax preparation is a critical aspect of accounting, but it can also be a complex and time-consuming process. ChatGPT can assist with this by answering questions about tax codes and regulations, and by automating tasks such as data entry and report generation. This can help to reduce errors and ensure that businesses are in compliance with tax laws.

Of course, like any technology, ChatGPT has its limitations. It’s not a replacement for human expertise, and it may not be able to handle every accounting task on its own. However, when used in combination with human expertise, it can be a powerful tool for improving efficiency and accuracy in accounting.

One of the biggest benefits of ChatGPT is its ability to learn and adapt over time. As it interacts with users and processes more data, it can become better at understanding and responding to text-based input. This means that it can improve over time, becoming more accurate and efficient as it learns.

Another benefit of ChatGPT is that it’s available 24/7. Unlike human employees, it doesn’t need to take breaks or go home at the end of the day. This means that it can be used to automate tasks that would otherwise require employees to work overtime or on weekends.

In accounting, ChatGPT can be used in a number of ways to improve efficiency and accuracy.

There are also cost savings associated with using ChatGPT in accounting. While there may be upfront costs associated with implementing the technology, such as training and integration with existing systems, over time it can save businesses money by reducing the need for human labor.

However, it’s important to note that ChatGPT is not a one-size-fits-all solution for accounting. It’s important to carefully evaluate whether the technology is appropriate for a particular business’s needs and goals. Some businesses may find that ChatGPT is not necessary or practical for their operations, while others may find that it’s a critical tool for improving efficiency and accuracy.

Another consideration when using ChatGPT in accounting is data privacy and security. Since the technology processes sensitive financial data, it’s important to ensure that appropriate security measures are in place to protect it. This includes measures such as encryption and access controls, as well as training employees on best practices for data privacy and security.

In addition to these considerations, it’s important to remember that ChatGPT is not infallible. Like any technology, it’s prone to errors and biases, and it may not always provide accurate or complete information. It’s important to carefully evaluate the output generated by ChatGPT and verify its accuracy through other means, such as manual review or confirmation with human experts.

Overall, ChatGPT has the potential to be a powerful tool for improving efficiency and accuracy in accounting. By automating tasks such as data entry, report generation, and accounts receivable and payable management, it can free up employees’ time to focus on more complex tasks and improve the overall quality of financial data analysis. However, it’s important to carefully evaluate the technology’s suitability for a particular business’s needs and goals, and to ensure that appropriate measures are in place to protect sensitive financial data. With careful planning and implementation, ChatGPT can be a valuable asset for businesses looking to streamline their accounting operations and improve their bottom line.

- The 19 Best Greek Restaurants in Chicago - June 22, 2023

- Oceangate CEO Stockton Rush: Driving Innovation at OceanGate - June 22, 2023

- Midjourney: Generative AI Image Generator - June 21, 2023